If you’ve chosen to be a yoga teacher, chances are crunching numbers is not where your passion lies.

Holding space, connecting with people, ancient philosophies, sacred texts, sharing the gifts of yoga…

…yes, yes, and yes.

Numbers and bookkeeping…

…not so much.

But we still gotta pay taxes as yoga teachers. And whether you work in a yoga studio or you are a virtual yoga instructor, there are a few things you can do to streamline the process.

From filing your own income tax to listing your own yoga teacher tax deductions, I’ll break down what you need to know this upcoming tax season. I’ll give you some tax tips that will get you on your way as an independent contractor.

Let’s take a look.

How To Prepare Your Taxes As A Freelance Yoga Instructor

Independent yoga instructors who want to pay a tax preparer this tax year can report their taxable income themselves.

But if you want my tax advice?

Get started early (like, yesterday). Not because it’s absolutely mandatory but because it makes your life a whole lot easier when tax season rolls around this year.

Tha way, you can get back to teaching yoga.

Step 1: Establish your type of employment

First things first, you need to know whether you are an employee or an independent contractor.

Typically, yoga teachers are independent contractors, but not always.

You could also be hired as an employee of a yoga studio.

As an employee, you must complete a W2 form when you start working with your employer. In this form, you can indicate how much to be withheld from your income each pay period. As you start earning, your employer makes tax deductions on your behalf, which you can see on each of your pay stubs.

This usually means when you file your tax return, you either get a tax refund or pay a lot less in taxes compared to how much you’d pay as an independent contractor.

We asked Lyle D. Solomon an attorney with Oak View Law Group in California and who specializes in the legalities of finances, how exactly this looks when it comes to taxes.

Independent Contractors or freelancers submit the 1099 form (schedule C) in Yoga teaching. However, if he/she works under any studio or fitness center, they will need to submit W2 FORMS sent from your employer. W2 forms are applicable only when you earn more than $600 in a financial year.

So what does this mean?

As an independent contractor, you are self-employed and running your own business. This means that you are responsible for reporting your adjusted gross income and that you are eligible for tax deductions.

If you work for multiple studios as well as for yourself as a private yoga instructor, then you will need to keep track of all taxable income and business expenses.

I’ll get into tax deductions for yoga teachers in a bit, or you can jump ahead here.

Step 2. Familiarize yourself with tax forms

As an employee of a yoga studio, you will be responsible for submitting the W2 form that the studio sends you.

As an independent contractor, you will be responsible for these three forms:

- Form 1040 (standard form to file a personal federal tax return)

- Schedule C (to report profit or loss from a business)

- Schedule SE (self-employment tax)

When you are self-employed, the IRS basically sees you and your business as one and the same. So, your business forms are filed alongside your personal tax return.

Because you don’t receive pay stubs nor are taxes not being deducted by an employer throughout the year, the two business forms you will submit are used to calculate the amount you earned and the amount you owe.

If you’re not being taxed on money you make as it comes in, you should most definitely be saving it along the way.

That way, it won’t sting AS bad when you have to drop a couple of stacks come April.

Step 3: Keep track of everything

Gather your receipts, pay stubs, checks you’ve deposited, and anything else you can think of that may be useful.

Keep all of these goodies in a filing system of some sort, ideally organized by month. This will make things MUCH easier once tax season rolls around.

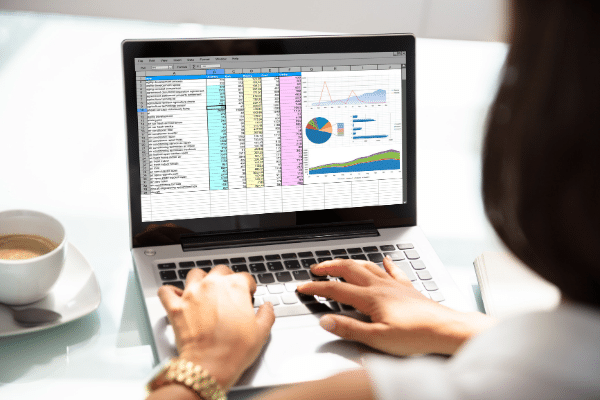

You also want to create a spreadsheet where you can track money coming in and keep a digital record of your expenses.

Make sure you stay on top of how many yoga classes you teach, how much you get paid for each class, and the mileage you use driving between studios.

I know staying on top of all of this can feel tedious, believe me, I know. But trust me, it will make things so much smoother for you in the long run.

Also Helpful: Managing Cash Flow and Profit in Your Yoga Business

Step 4: Understand tax write-offs

Yes, being an independent contractor comes with some extra responsibilities. But, it offers several advantages too.

The best part, you probably won’t have to pay tax on all of your income because you’ll be able to deduct business expenses when you file your tax return 🙂

The number you get after business deductions is what you’ll enter on your tax return as taxable income.

You do have to be careful with your business deductions, though.

The IRS says that business expenses must be both “ordinary and necessary” to be deductible.

By ordinary, they mean the expense must be common in the industry and something every yoga teacher spends money on.

Necessary means that the expense is essential to doing business.

Not to worry, we’ve got a list of the top tax deductions for you right here to make this easy-peasy for you.

Top Yoga Instructor Tax Deductions

A tax deduction is any business expense that is both essential to your work (aka teaching yoga) and is a common business expense in the industry. So theoretically, any money you spend on running your yoga business doesn’t count as taxable income…

…including education expenses.

Even if you decide to work with a tax preparer this year, keep track of all of the things you spend money on for business purposes. Keep the receipts and track everything in a spreadsheet. The tax pro will thank you.

1. Home office

According to the IRS, if you teach yoga from your home, you can deduct a percentage of your mortgage, rent, utilities, home insurance, and anything that relates to using your home as a business.

This means if your home office takes up one-eighth of the total square footage of your house, 12.5% of your payments are deductible.

2. Home office supplies

If you have a home office, you can also deduct expenses related to home office supplies! Including, computer equipment.

This means your laptop, printer, office furniture, and smaller items like notebooks, printer paper, and organizational supplies are all tax deductible.

3. Utilities, internet and household bills

Being that you operate a business from home, you can deduct the portion of your electricity, gas, and internet used to conduct business, too 🙂

4. Supplies related to your business

Supplies for a yoga business would be anything from yoga mats and props to spray bottles, towels, essential oils and candles. The same goes for digital tools, such as online teaching platforms or yoga apps. Or, even a sound system. Yup. All deductible, Keep those receipts people!

5. Marketing

Marketing materials for your yoga business such as business cards, flyers, or posters as well as costs for online advertising on platforms like Facebook, Instagram, and Google are all deductible.

Of course, website costs, email marketing, and any other advertising tools can also be deducted.

6. Insurance

Professional liability insurance is crucial as a freelance yoga teacher. And, it’s a deductible expense.

If you go through a CPR course, that can be written off also.

7. Mobile phone

Since phones have become a general source of conducting business, your phone bill can be a part of your deductions.

You can only deduct the percentage of the costs that are used for business, though. For example, if you use your phone for business 25% of the time, then 25% of your bill can be deducted.

8. Vehicle expenses

According to the IRS, you can deduct the standard mileage rate when driving between studios, driving to a client’s home for a private class, to a supplier, or a business meeting.

Take note, mileage between your home and the yoga studio is not on this list.

You can, however, write off work-related parking expenses.

9. Travel expenses

Teaching at a tropical yoga retreat, leading a workshop at a festival somewhere, or traveling for a teacher training course or yoga conference?

Accommodation costs, airfare, and other travel expenses are all tax deductible.

10. Professional service fees

If you hire a web designer, business coach, SEO analyst, or even an accountant to handle your bookkeeping, these can usually all be deducted as professional fees.

11. Continuing education and yoga teacher training costs

If you’re already a yoga teacher and a course is going to maintain or improve your skills as a teacher, guess what… Deductible 😉

This includes additional advanced yoga teacher training, continuing education courses, yoga and meditation workshops, conferences, and seminars.

However, any education course that qualifies you for new work cannot be deducted. Meaning, your first yoga teacher training course is not deductible.

As Solomon reminds us, per IRS guidelines, “if a yoga teacher is not self-employed, he/she cannot use the cost of yoga teaching as deductibles. This refers to Start-expenses with a limit of Deductible up to $5000.”

So it looks like you can’t claim your initial start-up expenses before you’re a practicing yoga instructor, including your first yoga teacher training.

Save Hours with my Proven Formula. FREE Yoga Business Plan Download

12. Subscriptions and memberships

Subscriptions and publications can generally be deducted because they support you in maintaining status within the industry as well as continuing your education.

Uh huh. That means your yearly membership fees for Yoga Alliance and even your monthly subscription to Elephant Journal AND Spotify are deductible.

13. Medical expenses

As of 2019, the IRS allows all taxpayers to deduct any medical expenses that exceed 7.5% of their adjusted gross income. If you’re earning $20,000 per year, then that means any expenses beyond $1,500 per year could be tax deductible. Though many of us avoid visiting the doctor like the plague thanks to the abysmal healthcare system in the US, this is helpful to know if you have an unexpected illness or condition that racks up your medical expenses each year.

Things That Are Not Tax Write-Offs As A Yoga Instructor

As you can see, a lot of expenses can indeed be written-off come tax time.

But that doesn’t mean that EVERYTHING is a tax write off. So before you go listing all of your yoga teacher tax deductions, beware of some of the most common pitfalls for independent yoga instructors.

Yoga apparel

I hate to be the bearer of bad news but…

…because yoga apparel is super trendy and often worn day-to-day by many people, it’s not considered a uniform or necessary for the job and therefore, can’t typically be claimed as a write-off.

Initial yoga teacher training course

While additional training courses can be deducted, your first training course cannot because it qualifies you for a new position.

As I mentioned, your studio may offer to reimburse you or subsidize the cost so definitely check in with them if you’re already working in a studio and about to get certified for the first time!

Mileage from home to the studio

Writing off mileage is one of the best parts of being self-employed. Okay, maybe not. But it is a pretty sweet perk.

Unfortunately, you can’t write off mileage from home to your principal place of work, AKA, the yoga studio you teach out of most frequently.

But, you can write off mileage between studios, to a client’s home for a private class, for a business lunch, and so on.

As long as it involves business and you aren’t going home, you’re good to go.

Common Questions about Yoga Teacher Tax Deductions

Looking for a very specific answer? Here are some of the most common questions I get from my students about filing taxes as a yoga instructor.

Can you write off yoga classes on taxes?

Absolutely! As a freelance yoga instructor, ongoing education and maintaining your skill set are essential parts of your business. Therefore, the cost of yoga classes can often be deducted as a business expense. This includes workshops, trainings, and any classes you take to improve your professional skills or to learn new ones. Just make sure these expenses are directly related to your business and you keep detailed records.

What is the IRS business code for yoga instructor?

For freelance yoga instructors filing taxes, the IRS business code you’re most likely looking for is 611620. This code is used for “Sports and Recreation Instruction,” which includes yoga instruction. Using the correct business code on your tax forms is crucial for proper classification and avoiding any issues with the IRS.

Can teachers deduct mileage on taxes?

Yes, yoga instructors can deduct mileage on their taxes, provided the travel is business-related. This includes traveling between multiple teaching locations, running errands for your business, or going to training sessions. You can deduct a standard mileage rate determined by the IRS each year, so keep a detailed log of your business miles for accurate reporting.

Can you write off certifications on your taxes?

Indeed, certifications are an investment in your professional development and directly enhance your teaching credentials. Therefore, the costs associated with obtaining or renewing certifications necessary for your role as a yoga instructor can typically be deducted as business expenses. This includes registration fees, study materials, and any related travel expenses.

Can you write off massages as a business expense?

Massages may fall into a gray area. If you can demonstrate that massages are essential for your physical well-being and directly impact your ability to perform your work as a yoga instructor (similar to professional athletes often needing physical therapy), you might be able to deduct them as a necessary business expense. However, this is subjective and could be scrutinized, so consult with a tax professional to ensure compliance and proper documentation.

An alternative or complementary approach involves utilizing a Health Savings Account (HSA) or Flexible Spending Account (FSA), if you have one. These accounts allow you to use pre-tax dollars for qualified medical expenses, which can include massages if prescribed by a physician for a specific condition. This can provide a tax-advantaged way to cover the cost of massages necessary for your physical upkeep as a yoga instructor, without having to justify them as a direct business expense.

The rules surrounding HSAs, FSAs, and what qualifies as a deductible business expense can be complex, so it’s crucial to consult with a tax professional to ensure compliance and proper documentation.

Can I write off Spotify as a business expense?

If you use Spotify exclusively for your classes to play music for your students, then yes, you can likely write off your Spotify subscription as a business expense. It’s important to have a dedicated account used solely for your business to clearly differentiate personal from business expenses. As with all deductions, ensure you keep detailed records in case of any inquiries from the IRS.

Remember, tax laws can vary and change, so it’s always a good idea to consult with a tax professional to ensure you’re making the correct deductions and following the latest IRS guidelines.

Final Words…

While this article can definitely help enlighten you on how to fill your taxes as a yoga teacher…

…and I really hope it does!…

Please keep in mind, there are some very specific rules around some of these deductions so it’s a good idea to seek advice from an accountant.

The cost of hiring an expert is most likely tax-deductible, anyway. So you can’t really go wrong, can ya?

May this tax season be the most peaceful one you’ve had yet 😉

Next Steps:

- Explore my Yoga Teacher Resource knowledge hub for more tips about how to grow your yoga business.

- Download my sequences for a jumpstart on your upcoming yoga classes!

- For more detailed tips, processes, and worksheets to supercharge your yoga business, download my yoga business launchpad course!

Sneak Peak into My 300-Hour YTT - FREE Videos, Info Session, Bonuses!

YOU MIGHT ALSO LIKE

- Somatic Yoga Workshop Ideas for Teachers

- Somatic Yoga For Yoga Teachers: Everything You Need to Know in 10 Steps

- How to Teach Somatic Yoga: A Practical Guide for Instructors

- How Much to Charge for Zoom Yoga Class: A Practical Pricing Guide

- Comprehensive Guide to Your Yoga Service Agreement

- How To Create Mindful Somatic Yoga Sequences Your Students Will Love

- What Is Mindset Coaching? A Complete Breakdown

- 5 Affordable Yoga Teacher Insurance Plans (Updated 2024)

- How To Make A Life Coaching Intake Form

- 7 Steps To Start A Life Coaching Business

- What Is A Self Love Coach? And How To Become One

- Self-Coaching: How To Become Your Own Life Coach

- Types Of Life Coaches: How To Choose Your Life Coaching Niche

- 20 Awesome Ways To Make Money As A Yoga Instructor

- Life Coach Marketing: A Comprehensive Guide For Long-Term Growth