Whether you’re teaching yoga online or in person, as an independent contractor or as a part-time yoga instructor with a yoga studio, investing in yoga liability insurance is always a good idea.

In addition to providing insurance for teachers, most insurance companies also offer discounted rates to students that extend post-graduation and into their first year of teaching.

With so many insurance companies offering different yoga insurance policies, finding the right one can seem like a daunting task.

And I get it.

You want to share your yoga practice with others, not decode the complicated yoga insurance policy world. But it’s important to understand the nitty-gritty behind yoga instructor insurance before you commit to an insurance policy because it will make a huge difference when things possibly go wrong.

So I have put together a list of 5 top-rated yoga insurance companies. I’ve outlined what each insurance policy offers, the liability coverage included, and links to where you can go to sign up.

Let’s get started.

What is the difference between general & professional liability?

Before you start shopping for yoga instructor insurance, it’s important to understand the different types of liability that are included in these insurance plans and why you need them. Ideally, your chosen yoga instructor insurance policy will include both general liability insurance and professional liability insurance coverage.

General liability insurance is often called the “slip and fall” insurance because it covers you in the event that one of your students hurts themselves during your class in a way that is not related to your instruction. For example, general liability insurance will protect you if a student slips and falls on account of a wet floor or trips over something during your class.

Professional liability insurance, on the other hand, is known as the “malpractice insurance”. This type of coverage protects you against claims that blame your alignment cues, adjustments, or even general sequencing for any injury or damage.

No matter which yoga style you teach, both of these types of policies are incredibly important for yoga professionals and are often included in even the most basic yoga teacher insurance policy.

Top 5 Yoga Instructor Insurance Companies

Finding the right insurance provider doesn’t have to be a mission. There are a few tried and true companies out there that have proven to be the most helpful to new and seasoned yoga instructors alike.

1. BeYogi

BeYogi offers all-inclusive yoga insurance for full and part-time teachers. Their insurance policies cover you wherever you teach including online live streaming and pre-recorded videos.

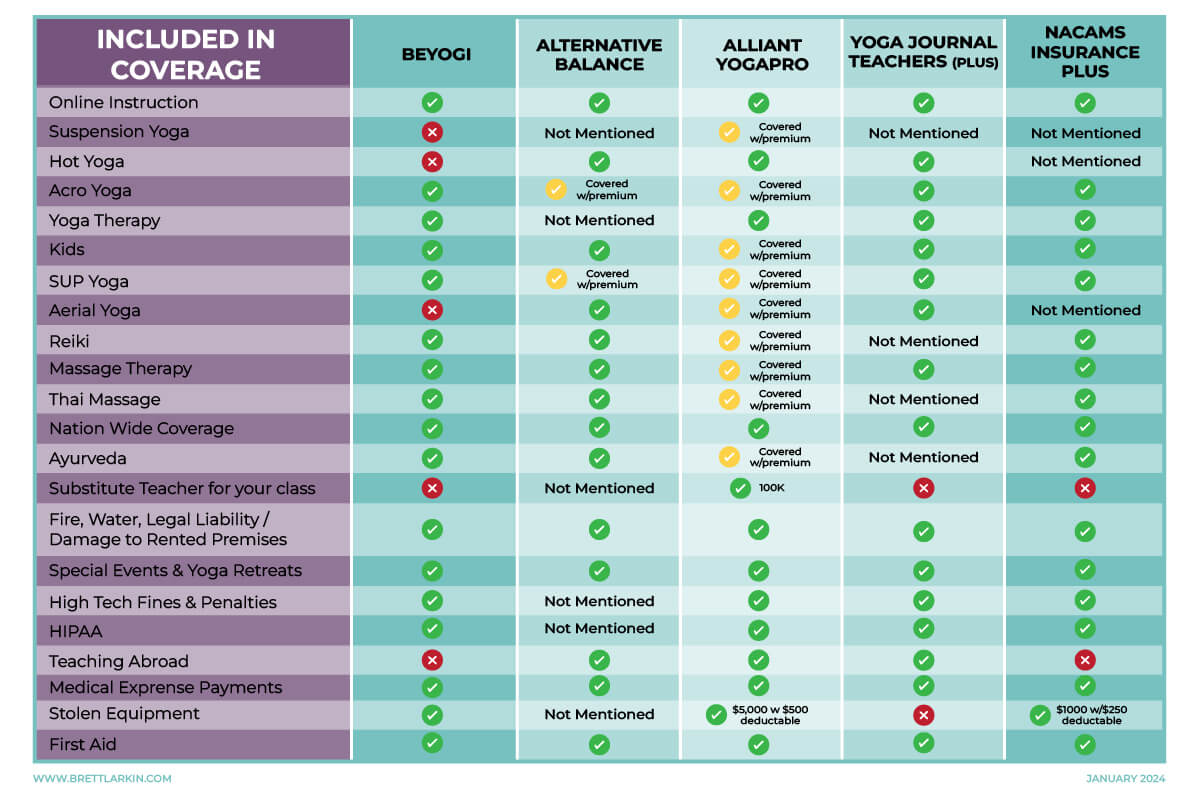

BeYogi’s insurance covers over 350 modalities including massage, reiki, acro and SUP yoga. Your coverage follows you wherever you teach, whether in a studio, on a lake or online. You can explore BeYogi’s complete list of covered modalities here.

Coverage Details:

- Professional/General Liability: $2 Million per occurrence / $3 Million annual aggregate

- Product Coverage: $2 Million annual aggregate

- Damage to Rental Premises: $100,000

- Identity Protection Coverage: $25,000

- Stolen Equipment Coverage: $1,000 w/ a $250 deductible

Policy Options and Pricing:

- Part-Time 1 year policy: $169 (12 months)

- Professional 1 year policy: $179 (12 months)

- Full-Time 2 year policy: $334 (24 months)

Learn more about member benefits or sign up to get insurance through BeYogi.

Disclaimer: I am an affiliate with BeYogi and so the link used to their insurance plan earns me a commission, should you choose to sign up for their services. While I believe in the company and insurance policy, I have not written this review with any bias. I have provided all relevant information on each company so that you can make an educated choice for yourself.

2. AlternativeBalance

AlternativeBalance offers four membership levels to fit the insurance needs of students, independent contractors and employers in the yoga industry. Their membership includes liability insurance, business tools, waiver templates, exclusive partner discounts and more.

They offer coverage for over 500 services as well as premium services that are available at an extra expense. Check out AlternativeBalance’s full list of covered and premium services here.

Coverage Details:

- General & Professional Liability Aggregate: $3 million

- General & Professional Each Occurrence: $2 million

- Products-Completed Operations Aggregate: $2 million

- Damage to Premises Rented to You: $300,000

- Third-Party Medical Expenses: $5,000

- Personal & Advertising Injury: Included

- Defense Costs: Included

Policy Options and Pricing:

- Student (currently enrolled in trade school): $189/year

- Per Diem (working less than 10 hours/week): $239/year

- Professional (working more than 10 hours/week): $269/year

- Employer: $319/year plus $99 for each employee.

Interested in learning more? You can find all policy details and sign up with AlterntiveBalance here.

Fall in love with my 300-Hour teacher training or …

3. Alliant YogaPro

Yoga Alliance and Alliant Insurance have teamed up to create Alliant YogaPro. Alliant YogaPro coverage is tailored to meet the needs of yoga teachers who work within a studio as employees or independent contractors teaching at students’ homes or other venues. In addition to offering individual policies for yoga teachers, Alliant YogaPro also offers separate coverage options for yoga studios, yoga schools and small yoga businesses.

Only members of Yoga Alliance in the United States and Canada can apply for insurance through Alliant YogaPro.

For coverage details, policy options and pricing you must apply. Read FAQs or apply on their website here.

Coverage Details:

- General & Professional Each Occurrence: $1M each claim

- General & Professional Liability Aggregate: $2M aggregate

Policy Options and Pricing:

- Part-Time: 1M/2M Premium, $110 annually

- Part-Time: 2M/4M Premium, $122 annually

- Full-Time: 1M/2M Premium, $125 annually

- Full-Time: 2M/4M Premium, $146 annually

4. Yoga Journal Teachers(Plus)

TeachersPlus insurance offers both full and part-time insurance and membership options. In addition to offering affordable yoga instructor liability insurance, membership includes online courses, premium content, benefits, discounts and more.

Both Full-Time (teaching 6+ hours/week) and Part-Time (teaching less than 6 hours/week) include benefits of:

- Instant Coverage

- All Styles of Yoga Included

- Retreats, Workshops and Private Clients Included

- Library of Curated Yoga Playlists

- Exclusive Content, Contests, Discounts and More

To learn more about specific policy coverage and pricing, you must apply. To learn more or apply for coverage from TeachersPlus, visit their website here.

5. NACAMS Insurance Plus

NACAMS covers 350+ disciplines and modalities and includes professional and general liability insurance. NACAMS provides affordable access to liability insurance for yoga teachers, reiki practitioners, massage therapists, physical therapists, personal trainers and more. They offer instant coverage and proof of insurance at checkout. Member benefits include stolen equipment coverage, identity protection, a free website and exclusive product discounts.

Coverage Details for NACAM Professional Policy:

- Professional & General Liability: $2 million per occurrence, $3 million individual annual aggregate

- Product Coverage: $2 million

- Stolen Equipment Coverage: $1,000 *$250 deductible

- Free Website & Teacher Resources

- Identity Protection Plan

NACAMS offers both Professional and Student policies, but do not list pricing on their website. To learn more or get a quote, visit NACAM’s website here.

With so many yoga teachers gravitating toward teaching online, it is important to keep in mind that depending on the type of class you are teaching online your yoga liability insurance may not cover you. You can read more about what is covered and what is not when teaching online in this article, Does Yoga Insurance Cover Online Classes?

It’s important to consider exactly the ways in which you will need coverage so that you can choose the yoga instructor liability insurance that is right for you.

Yoga Insurance Companies – Comparing Coverage

What you need to know about yoga teacher insurance

How much does yoga insurance cost?

Considering the value that you get when you pay for general liability coverage, yoga insurance is fairly cheap. Most liability coverage is priced between $100 and $200 per year for an independent contractor (aka freelance yoga instructor). Professional liability coverage for a business owner or yoga studio, which often covers not only the yoga student but the instructor as well, will be more expensive. As a business owner with employees, you can expect to pay anywhere from $200 to $300 per year, plus additional fees per yoga instructor covered on the insurance policy.

What modalities are covered by yoga liability insurance?

Most yoga teacher insurance policies will cover virtually any modality under the umbrella of yoga, though it’s important to check with your insurance provider to be sure. In fact, professional liability insurance isn’t necessarily limited to the yoga industry alone. A personal trainer, pilates instructor, or yoga instructor alike can find insurance coverage that covers a wide range of activities and scenarios. While this may be true, it’s important to do your due diligence when selecting an insurance program.

When should I buy yoga liability insurance?

Because yoga instructor insurance is so affordable, many yoga teachers choose to enroll in some kind of insurance program during their yoga teacher training course. As many teacher training programs require contact hours, both general and professional liability coverage will cover you in the event of a yoga injury or accident.

Otherwise, it is super important to secure some kind of general liability coverage when you begin teaching yoga to others. It is also advised to use a yoga liability waiver for each yoga class, as well, to ensure that you are fully protecting yourself every step of the way.

How do I find the best yoga insurance for me?

Choosing your insurance coverage depends on how often you teach yoga, where you teach yoga, and which styles of yoga you will be teaching. It also depends on your budget and what kind of support or benefits you’re looking for in an insurance policy. When selecting an insurance company, consider the following points:

– Insurance program prices

– Which modalities you would like to be covered (ie, will you be practicing yoga therapy or teaching a group yoga class? will you teach multiple styles of yoga or assisting on a yoga teacher training? are you also a personal trainer or pilates instructor?)

– What does the liability coverage include? Does it cover your yoga class at a yoga studio only? Or does it cover private lessons held anywhere, like with SUP yoga? Does this yoga insurance policy include online yoga classes?

– Additional benefits that might be helpful to you, like bodily injury, medical bills, commercial property coverage, workers compensation, malpractice insurance, etc.

How much coverage should I have for my yoga liability insurance?

While I cannot officially recommend what kind of yoga insurance coverage to select for yourself, an industry-standard is to $2 million per occurrence and $3 million annual aggregate. It is also recommended to have some kind of coverage for property damage, medical expenses, and product coverage.

Should I get liability insurance if I am a student in yoga teacher training?

Most yoga professionals will recommend that you get some kind of yoga insurance coverage even as a student in a yoga teacher training. This is because you still give yoga instruction during these trainings and in the event that something happens, like a bodily injury or property damage, you will be protected. That being said, this is a personal choice that you have to make for yourself.

As a yoga teacher, what kind of insurance do I need?

The two most common (and important) types of yoga teacher insurance that you need for yoga instruction are general liability insurance, which covers accidents that can lead to bodily injury, and professional liability insurance, which covers malpractice claims. With this combination, you will be covered for both accidents, like slipping or falling, as well as any claims of negligence made by one of your students.

Many insurance policies offer additional services, like product coverage liability, property damage coverage, and even stolen equipment coverage. Product coverage is helpful if you are a massage therapist, for example, and your client has an adverse reaction to the product that you use. Similarly, property coverage is helpful if any property damage accidentally occurs as a result of your instruction.

It’s important to consider exactly the ways in which you will need coverage so that you can choose the yoga instructor liability insurance that is right for you.

Next Steps:

- Explore my Yoga Teacher Resource knowledge hub for more tips about how to grow your yoga business.

- Download my sequences for a jumpstart on your upcoming yoga classes!

- For more detailed tips, processes, and worksheets to supercharge your yoga business, download my yoga business launchpad course!

Save Hours with my Proven Formula. FREE Yoga Business Plan Download

YOU MIGHT ALSO LIKE

- How To Build a Thriving Virtual Community with an Online Yoga Membership

- Somatic Yoga Workshop Ideas for Teachers

- Somatic Yoga For Yoga Teachers: Everything You Need to Know in 10 Steps

- How to Teach Somatic Yoga: A Practical Guide for Instructors

- How Much to Charge for Zoom Yoga Class: A Practical Pricing Guide

- Comprehensive Guide to Your Yoga Service Agreement

- How To Create Mindful Somatic Yoga Sequences Your Students Will Love

- 5 Affordable Yoga Teacher Insurance Plans (Updated 2024)

- 20 Awesome Ways To Make Money As A Yoga Instructor

- Yoga Cues 101: Everything You Need To Teach Yoga

- How Much Do Yoga Teachers Make? (And How To Earn More)

- How To Incorporate Somatic Coaching Into Your Yoga Practice

- How to Easily Modify 6 Common Yoga Poses [+VIDEO]

- Try This 30-Minute Yoga Nidra Script for Deep Sleep and Relaxation [+ Video]

- 8 Best Yoga Podcasts For Yogic Business And Living